Self Employment Ledger

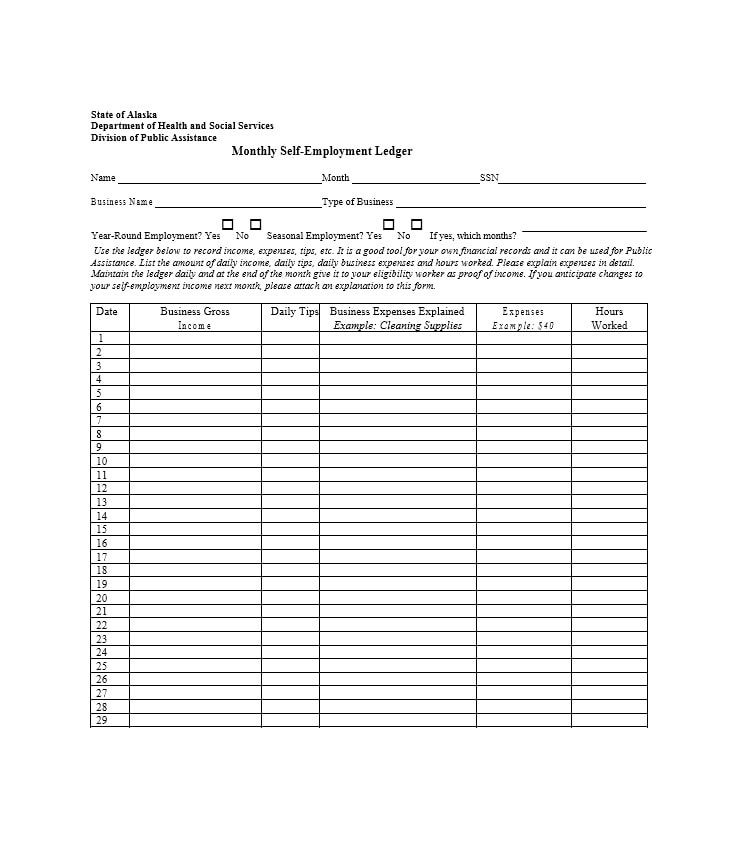

sample of a self-employment ledger can be downloaded from the South Dakota website in portable document file (PDF) format. It should be noted that there is no official self-employment form or ledger, and any document that clearly breaks down an individual's income and expenses is essentially a self-employment ledger, notes the Trout Insurance website.

The Internal Revenue Service (IRS) requires self-employed taxpayers to provide a self-employment ledger to verify their income. A self-employment ledger will also be helpful when applying for health care coverage through the Marketplace. The information from the ledger will help determine if the applicant qualifies for a lower health care coverage cost, as stated on Healthcare.gov.

The following shows how to download a sample of a self-employment ledger from the South Dakota official government website.

- Go to the state website

- Go to the online forms page

- Use the search tool

- Print or save the ledger

Type SD.gov into the browser and press Enter.

Navigate to the online forms page by mousing over the Online Services option on the main menu of the home page and then clicking on Online Forms.

Type "self-employment ledger" into the search tool to search for the sample ledger.

Click on the monitor icon on the TANF Self-Employment to display the PDF file on the screen. The form can be filled out while it is still on the screen. Click on the corresponding icon on the bottom right corner of the screen to save or print the form.

Comments

Post a Comment